Project Name

How Ksolves AI-Powered Loan Risk Assessment is Revolutionizing Credit Decisions

![]()

Our client is a Merchant Cash Advance Provider that lends loans to small business owners and helps them grow their businesses smoothly. They want a system to assess the credit risk ability of various merchants and predict the likelihood of default by building custom AI/ML models.

The key challenges faced by the client are as follows:

- With increasing applications daily, clients must transition from their current manual loan distribution process to an automated one.

- To address this challenge, the client requires an automated AI / ML model capable of real-time prediction to distinguish between creditworthy and high-risk merchants.

- This urgency stems from the significant number of merchants failing to meet daily payment obligations, a trend that can ultimately result in defaults.

We have provided our client with comprehensive solutions that meet the needs as shown below:

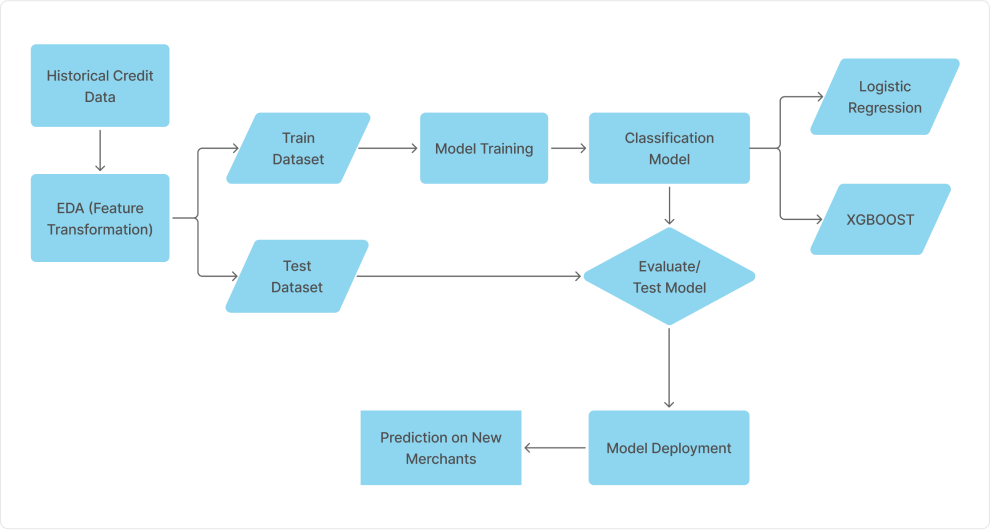

- Leveraging historical data, we employ advanced analytics to identify patterns in merchant behavior, allowing us to gain insights into their repayment tendencies.

- Based on these identified patterns, we segment merchants according to their likelihood of defaulting on loans. This segmentation enables us to manage risk effectively.

- Merchants with a low probability of default, as determined by our model, are considered eligible for renewal cash advances. This approach ensures that we continue to support reliable businesses.

- We utilize Logistic Regression, a powerful machine-learning technique, to extract valuable patterns from historical data analysis. This method provides a clear understanding of the factors influencing default probability.

- Our solution operates in near real-time, enabling us to make quick and informed decisions on loan approvals and renewals, ensuring efficient and risk-conscious lending practices.

- Additionally, we've harnessed state-of-the-art methods like XGBoost and Random Forest, improving our ability to assess and predict merchant default probabilities with greater precision and robustness.

Through this project, we have successfully empowered our clients to identify genuine and eligible customers for loan renewals. We have enhanced the client’s ability to make informed decisions by leveraging data-driven insights and employing advanced AI techniques. This reduces the risk of defaults and ensures that their resources are directed toward supporting reliable and deserving businesses. The project’s success underscores the value of data analytics and automation in optimizing the loan renewal process and enhancing the client’s overall business operations.

Optimize Loan Risk Assessment with Ksolves AI Solutions!