Project Name

AI-Powered Loan Risk Assessment: Revolutionizing Credit Decisions for Small Business Financing

Overview

Our client works as a Merchant Cash Advance Provider who gives loans to small business owners and helps them grow their businesses smoothly. They want a system to assess the credit risk ability of various merchants and to predict the likelihood of default with the help of building custom AI/ML models.

Challenges

- With an increasing number of applications daily, clients must transition from their current manual to an automated loan distribution process.

- To address this challenge, the client requires an automated AI / ML model capable of real-time prediction to distinguish between creditworthy and high-risk merchants.

- This urgency stems from the significant number of merchants failing to meet daily payment obligations, a trend that can ultimately result in defaults.

Our Solution

We have provided our client a comprehensive solutions that meet the needs as shown below:

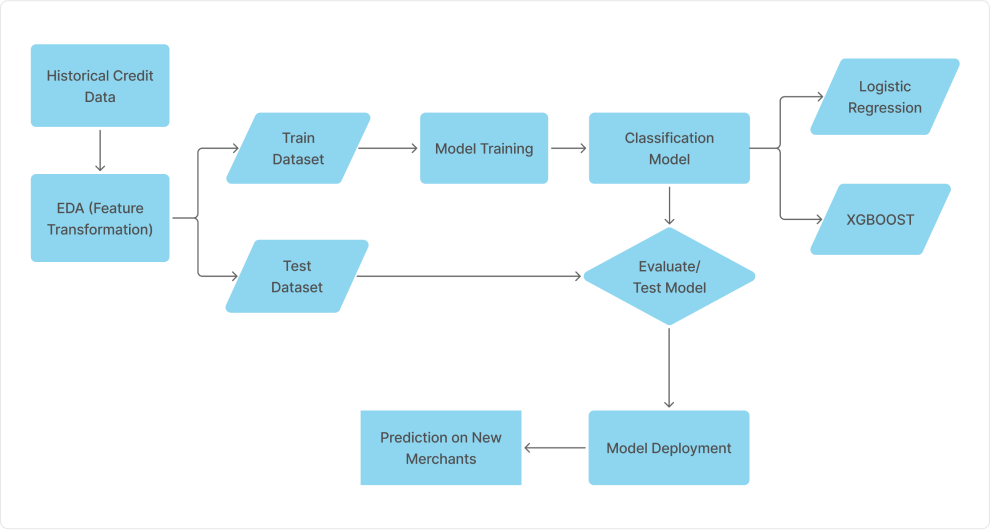

- Leveraging historical data, we employ advanced analytics to identify patterns in merchant behavior, allowing us to gain insights into their repayment tendencies.

- Based on these identified patterns, we categorize merchants into different groups according to their likelihood of defaulting on loans. This segmentation enables us to effectively manage risk.

- Merchants with a low probability of default, as determined by our model, are considered eligible for renewal cash advances. This approach ensures that we continue to support reliable businesses.

- We utilize Logistic Regression, a powerful machine-learning technique, to extract valuable patterns from historical data analysis. This method provides a clear understanding of the factors influencing default probability.

- Our solution operates in near real-time, enabling us to make quick and informed decisions on loan approvals and renewals, ensuring efficient and risk-conscious lending practices.

- Additionally, we've harnessed state-of-the-art methods like XGBoost and Random Forest, further improving our ability to assess and predict merchant default probabilities with greater precision and robustness.

Data Flow Diagram

Conclusion

Through this project, we have successfully empowered our clients to identify genuine and eligible customers for loan renewals. By leveraging data-driven insights and employing advanced AI techniques, we have enhanced the client’s ability to make informed decisions. This not only reduces the risk of defaults but also ensures that their resources are directed toward supporting reliable and deserving businesses. The project’s success underscores the value of data analytics and automation in optimizing the loan renewal process and enhancing the client’s overall business operations.

Streamline Your Business with Our

Data Streaming Solutions

Streamline Your Business with Our

Data Streaming Solutions